Within the past 30 days, our consensus EPS projection has moved 1.15% lower. It has a remarkable, outside-audited track record of success, with #1 stocks delivering an average annual return of +25% since 1988. The Zacks Rank system ranges from #1 (Strong Buy) to #5 (Strong Sell). Our system takes these estimate changes into account and delivers a clear, actionable rating model. We developed the Zacks Rank to capitalize on this phenomenon. Research indicates that these estimate revisions are directly correlated with near-term share price momentum. With this in mind, we can consider positive estimate revisions a sign of optimism about the company's business outlook.

These revisions typically reflect the latest short-term business trends, which can change frequently. It is also important to note the recent changes to analyst estimates for Snap.

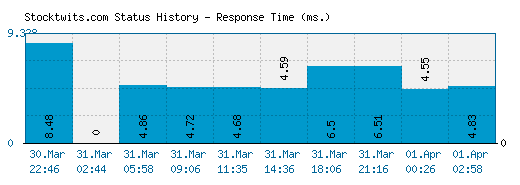

#SNAP STOCKTWITS FULL#

Our most recent consensus estimate is calling for quarterly revenue of $1.05 billion, down 5.65% from the year-ago period.įor the full year, our Zacks Consensus Estimates are projecting earnings of $0.04 per share and revenue of $4.51 billion, which would represent changes of -76.47% and -1.99%, respectively, from the prior year. On that day, Snap is projected to report earnings of -$0.04 per share, which would represent a year-over-year decline of 100%. Wall Street will be looking for positivity from Snap as it approaches its next earnings report date. This has outpaced the Computer and Technology sector's gain of 3.15% and the S&P 500's gain of 3.58% in that time. Prior to today's trading, shares of the company behind Snapchat had gained 28.15% over the past month. Meanwhile, the Dow gained 0.47%, and the Nasdaq, a tech-heavy index, lost 3.19%. This change lagged the S&P 500's 0.68% loss on the day.

#SNAP STOCKTWITS FREE#

Snap’s earnings could serve as a good indicator of the health of the digital ad market in general, and set the stage for earnings reports from the likes of Meta and Alphabet next week.In the latest trading session, Snap ( SNAP Quick Quote SNAP - Free Report) closed at $12.93, marking a -1.37% move from the previous day. That should enable users to access their conversations without having to pull out their phones while sitting at the desks. This month, the company also announced it is bringing Snapchat to desktop computers. Priced at $3.99, Snapchat+ promises users access to "exclusive, experimental, and pre-release features." In a bid to raise revenue, Snap announced Snapchat+ subscription service in June. ad spending is slowing,” Hargreaves Lansdown analyst Laura Hoy told Yahoo Finance Live. “The revenue miss was certainly disappointing, and I think it sort of confirmed. It doesn’t help that Snap is dealing with a cavalcade of negative news including the continued damage caused by Apple’s App Tracking Transparency, which reduces how much data apps can collect on users a broader slowdown in the advertising space and headwinds from COVID and the war in Ukraine. Shares are off a brutal 65% year-to-date, putting it in the rare company of the likes of Netflix, which is down 63%. But even among beaten down tech stocks, Snap is a dog. Tech stocks have been eviscerated this year, with shares of Amazon down more than 25% and shares of Facebook parent Meta off 45% year-to-date.

0 kommentar(er)

0 kommentar(er)